Markup:

is the difference between the price of a product and the cost of that product.E.g if cost of goods is Rs $100 and you add $50 to this to arrive at the retail price of $150 then the mark up is Rs 50

Markup=Selling Price-Cost

Markup Percentage:

A markup is what percentage of the cost price do you add on to get the retail price. E.g if cost of goods is $100 and you add $50 to this to arrive at the retail price of $150 then the mark up is $50 and the mark up percentage $50%.

Markup Percentage=100 ÷ Cost* Profit Amt

Margin:

The difference between the cost of an item and its price E.g if cost of goods is Rs $100 and the retail price of $150 then the rupee margin is $50

Margin=Price-Cost

Margin percentage:

The gross profit or margin expressed as a percentage of the retail price. E.g if cost of goods is Rs 100/- and the retail price of Rs 150/- then the rupee margin is Rs 50/- and the margin percentage is 33.34%.

Margin percentage(30%) = Price ÷ 100*30

What is the difference between Markup and Margin?

Markup is calculated from the cost where as the marigin is calculated from Selling price.

eg. Consider selling price of a item is $100 and cost is $50

If i say 50% margin then my profit is $50

If i say 50% markup then my selling price for this item will be $75 so my profit will be $25.

Friday, June 26, 2009

Tuesday, June 16, 2009

What is Assortment Planning ?

- Assortment refers to the number of SKUs within a merchandise category, group or department(depending on the retailers reference).

- Assortment planning is the process to determine what and how much should be carried in a merchandise category. Assortment plan is a trade-off between the breadth and depth of products that a retailer wishes to carry.

- Fashion categories contain lesser details in the plan.

- Questions to be considered:

- Which SKU’s drive sales and profits?

- What criteria should be used for adding and deleting items?

- Is the retailer missing opportunities by not carrying certain items?

- Which items represent true variety, not duplication?

- Which items are critical to consumer loyalty or category image?

- Which items are not contributing to the category?

Assortment Planning-Key highlights

| Apparel | Non-Apparel |

|

|

Important terms in Retail

Here are some of the Important Terms that are frequently used in retail industry.

List of Important terms in Retail:

SKU

An identification number assigned to a unique item by the retailer. The SKU (Stock Keeping Unit) may be an internal number to that retailer or may be tied to an item's UPC (Universal Product code) or EAN (European Article Number).(Major retailers use UPC or EAN barcodes)

UPC – Universal Product code

The Uniform Code Council (UCC) UPC code numbering system is a 12 digit numeric sequence.

Click on the image for enlarged view

The UPC numeric code consists of four partitions

The first partition consist of a single digit indicating the numbering system used to interpret the remaining characters. - A ‘0’, for example, designates a regular UPC code, a ‘3’ a National Drug Code and a ‘5’ a coupon.

The next five digits designate the manufacture identification number, and the following five, the item number. Item numbering is maintained by the associated manufacture that must ensure unique numbers for each product type.

Finally, a single digit is added as a check character used to validate the correct interpretation of the machine scan.

EAN – European Article Number

This is the european version of product coding and comprises 13 digits called EAN13 series and 14 digits called EAN14

Assortment

It is the number of SKUs within a category. It is also called depth.

Category

The category is the basic unit of analysis for making merchandising decision.

Category Captain

Most retailers build a favored relationship with a selected vendor in terms of CPFR etc. to help them manage a particular category. This vendor is then called a Category Captain.

Variety

It is the number of different merchandising categories within a store or department. It is also called breadth.

Backup stock

It is the safety stock or buffer stock and is used to guard against going out of stock when demand exceeds forecast or when the delivery of merchandise is delayed.

Buyer

A decision maker at a Retailer who decides which products of a category are bought and what is the quantity that should be delivered and displayed at each store.

Private Label

Private Label brands also called store brands are products developed by Retailers and available for sale only from that Retailer.

Space Management

“Management of selling space, based on consumer demand and shopping habit in order to achieve enhanced business results”.

Order Quantity

It is the quantity of merchandise that is ordered whenever the order point is reached.

Shrinkage

It is the reduction in inventory that is caused by shop lifting or due to damage/misplacement or due to poor bookkeeping.

Shoplifting

What is shoplifting? Shoplifting is the theft of property which is worth less than $500 and which occurs with the intent to deprive the owner of that piece of property. The crime of shoplifting is the taking of merchandise offered for sale without paying.

Softlines

A store department or product line primarily consisting of merchandise such as clothing, footwear, jewelery, linens and towels.

Fad Merchandise

Item that generate a high level of sale for a short period is called as fad merchandise.

Black Friday

Black Friday is the discount shopping day that follows American Thanksgiving, which is always on a Thursday. Retailers promote Black Friday as the day to start shopping for Christmas.

In retail an anchor store, draw tenant, anchor tenant or key tenant, is one of the larger stores in a shopping mall, usually a department store or a major retail chain, whose presence attracts business to smaller shops within the mall.

CoCo (Corporate Owned Company Operated)

CoDo (Corporate Owned Dealer Operated)

DoDo ( Dealer Owned, Dealer Operated)

BHHD (Batch Hand Held Device)

FPC (Future Price Change)

SSCC(Serial Shipping Container Code)

UOM (Unit Of Measure)

PCS (Petroleum Convenient Stores)

QSR (Quick Service Restaurant)

List of Important terms in Retail:

SKU

An identification number assigned to a unique item by the retailer. The SKU (Stock Keeping Unit) may be an internal number to that retailer or may be tied to an item's UPC (Universal Product code) or EAN (European Article Number).(Major retailers use UPC or EAN barcodes)

UPC – Universal Product code

The Uniform Code Council (UCC) UPC code numbering system is a 12 digit numeric sequence.

Click on the image for enlarged view

The UPC numeric code consists of four partitions

The first partition consist of a single digit indicating the numbering system used to interpret the remaining characters. - A ‘0’, for example, designates a regular UPC code, a ‘3’ a National Drug Code and a ‘5’ a coupon.

The next five digits designate the manufacture identification number, and the following five, the item number. Item numbering is maintained by the associated manufacture that must ensure unique numbers for each product type.

Finally, a single digit is added as a check character used to validate the correct interpretation of the machine scan.

EAN – European Article Number

This is the european version of product coding and comprises 13 digits called EAN13 series and 14 digits called EAN14

Assortment

It is the number of SKUs within a category. It is also called depth.

Category

The category is the basic unit of analysis for making merchandising decision.

Category Captain

Most retailers build a favored relationship with a selected vendor in terms of CPFR etc. to help them manage a particular category. This vendor is then called a Category Captain.

Variety

It is the number of different merchandising categories within a store or department. It is also called breadth.

Backup stock

It is the safety stock or buffer stock and is used to guard against going out of stock when demand exceeds forecast or when the delivery of merchandise is delayed.

Buyer

A decision maker at a Retailer who decides which products of a category are bought and what is the quantity that should be delivered and displayed at each store.

Private Label

Private Label brands also called store brands are products developed by Retailers and available for sale only from that Retailer.

Space Management

“Management of selling space, based on consumer demand and shopping habit in order to achieve enhanced business results”.

Order Quantity

It is the quantity of merchandise that is ordered whenever the order point is reached.

Shrinkage

It is the reduction in inventory that is caused by shop lifting or due to damage/misplacement or due to poor bookkeeping.

Shoplifting

What is shoplifting? Shoplifting is the theft of property which is worth less than $500 and which occurs with the intent to deprive the owner of that piece of property. The crime of shoplifting is the taking of merchandise offered for sale without paying.

Softlines

A store department or product line primarily consisting of merchandise such as clothing, footwear, jewelery, linens and towels.

Fad Merchandise

Item that generate a high level of sale for a short period is called as fad merchandise.

Black Friday

Black Friday is the discount shopping day that follows American Thanksgiving, which is always on a Thursday. Retailers promote Black Friday as the day to start shopping for Christmas.

In retail an anchor store, draw tenant, anchor tenant or key tenant, is one of the larger stores in a shopping mall, usually a department store or a major retail chain, whose presence attracts business to smaller shops within the mall.

CoCo (Corporate Owned Company Operated)

CoDo (Corporate Owned Dealer Operated)

DoDo ( Dealer Owned, Dealer Operated)

BHHD (Batch Hand Held Device)

FPC (Future Price Change)

SSCC(Serial Shipping Container Code)

UOM (Unit Of Measure)

PCS (Petroleum Convenient Stores)

QSR (Quick Service Restaurant)

Strategic Performance Analytics GMROI,GMROS and GMROL, The Key ‘Retail Measure’

Some of the tools that are very useful in Strategic Performance Analysis are GMROI, GMROS and GMROL

GMROI - Gross Margin return on Investment

GMROI is a planning and decision making tool used by the retailers to calculate their profit from the investment made. GMROI measure inventory productivity that expresses the relationship between your total sales, the gross profit margin you earn on those sales, and the number of rupees you invest in inventory. GMROI also called as GMROII stands for Gross Margin Return On Inventory Investment.

Thus GMROI assist buyers in evaluating whether a sufficient gross margin is being earned by the SKU's purchased, compared to the investment in inventory required to generate those gross margin dollars. GMROI shift the business focus from the sales to the profitability. GMROI actually make you to talk in percentage which almost all the successful business people likes talk about.

GMROI = Gross Margin($)/Average Inventory at Cost = Gross Margin % x Inventory Turn

Two main things that we need to calculate is

i) Average inventory at cost

ii) Gross margin of the item

Average inventory at cost is obtain by adding beginning cost inventory for each month and the ending cost inventory for the last month in the period divided by total months plus 1.

Average Inventory at Cost = (beginning of each month + ending cost of last month) / total number of month + 1

consider if we need to calculate the Average inventory at cost for 3 months from Jan 2010 to Mar 2010. Then Average inventory at cost = (beginning cost inventory for Jan 2010 + beginning cost inventory for Feb 2010 + ending cost inventory for Mar 2010)/4

Gross margin of the item is the difference between total sales of the item and the cost of goods sold.

Gross Profit = Revenue − Cost of Sales

or

as the ratio of gross profit to sales revenue, in the form of a percentage:

Gross Margin Percentage = (Revenue-Cost of Sales)/Revenue

How to improve GMROI:

Gross margin is the value of sales minus the cost of goods sold. To increase gross margin, you must either increase sales revenue or reduce the cost of the merchandise. The obvious way to increase sales revenue is simply to increase prices. Unfortunately, in a competitive environment, that is not so simple.

Here are three possible strategies to employ to increase GMROI:

- Raising Prices

- Careful Use of Markdowns

- Reducing Cost of Goods Sold

Raising Prices

A common rule of thumb is to avoid price increases on products that are known value items or those that your competitors focus on for price comparisons. Sample Steps for implementing a price increase at first is by defining a representative sample selection of products from your stores. Each product should be of a particular size or be aimed at a particular demographic. Select a control group that resembles as closely as possible the first group. Increase prices in the sample stores and track how sales perform against the control group during a trial period. If there is little or no effect on sales, you can roll out the price change throughout your stores.

Reducing Markdowns

Reducing markdowns is another strategy for improving GMROI. To do this, track the SellThrough % by store. Suppose Store A is selling faster than plan and will sell out early. Store B is selling slower than plan but a markdown may help it along. Store C is doing really poorly and even a large markdown may not be enough to clear the problem. In this case, consider moving merchandise from Store C to Store A, where it can still sell at full price. This capacity to apply markdowns selectively and transfer goods judiciously is an important component in increasing gross margin.

Reducing Cost of Goods Sold

Reduction in COGS is used to measure the success of the manufacturing product. this fundamentally captures material, labor, overhead and tooling costs. You can, for example, analyze vendor performance and possibly order products from different vendors. Again, this is not a simple decision and must be considered with other factors. For example, one vendor may be a little more expensive but delivers on time and offers better quality with fewer returns. When all the factors are considered, the more expensive supplier may, in fact, be "Cheaper."

Specific benefits of GMROI

- GMROI exposes the actuall profits in dollars vs paper profits

- GMROI shift focus from sales to the return-on-investment of the product

- Also GMROI shift SKU's focus from total department to the individual product

- GMROI differentiate product "winners" from products "starving to become winners"

- GMROI identifies "core" business/never outs

(Product "winners" are those which boost profitability (i.e.) it gives best return on investment. Products "starving to become winners" is the one which has all the qualities to become winners but under a specified category)

('Core products' are those list out the existing winners which is selected at all times. It gives best return on investment. 'Never out" are those product change occasionally according to the season and by location.

GMROS - Gross Margin Return on Selling Area

GMROS also called as GMROF (Gross Margin Return on Feet). GMROS is a measure of inventory productivity that expresses the relationship between your gross margin, and the area allotted to the inventory. GMROS express the profit percentage

(i.e) how much returns you've got per area (selling feet) during a specified period. In a simple term, GMROS is a measure of gross margin returns on space occupied by a particular category of the store

GMROS = Gross Margin% x Net Sales /Selling Area

GMROL - Gross Margin Return on Labor

GMROL is a measure of inventory productivity that expresses the relationship between your gross margin, and the full time employee. It explains the profit gained by a full employee in a specific period of time.

GMROL= Gross Margin % x Net Sales /Full Time Equival.

Full Time Equival= E1*H1*D1 + E2*H2*D2 + E3*H3*D3* + ……/ Hrs. in regular shift * No. of working days in a week

Where,

E = Employees, H = Hours worked, D = Days worked

- It is a relation between Gross Margin and Stock Turns

- Gross margin is the value of sales less the cost of goods sold

- Increasing gross margin entails increasing sales revenue or reducing the cost of the merchandise

- Increasing Stock Turns means reducing the inventory carry cost

- Thus this measure gives you insight into the retailers performance

Labels:

Benefits of GMROI,

Core,

GMROF,

GMROI,

GMROL,

GMROS,

Never out,

performance stratergy in retail,

Product winners

Complete Retail Solution, What should a complete retail management software have?

Click on the image for enlarged view

Point of Sale (POS) and Store Management module:

- POS interface with Tag readers/Card readers/Printers/Cash Drawers

- Automated change of SKU description, prices from POS server/SMS server (Info from HQ)

- Day end/shift end Account consolidation functionality with Store front associate id

- Trigger based Data transfer to POS server or SMS server and vice versa

- Self Diagnostics and error warning system

- POS or Till Training (simulation) software

- Day end report generation with Cash reduction and irregular drawer openings monitoring

- Module specific reports and Maintenance

Merchandise Management (MM):

- Merchandise nomenclaturing, hierarchy generation/mapping, item maintenance and grouping tools

- Category and Assortment Management, product mix optimization with private label initiative

- Purchasing, vendor selection, management and contracts and ordering

- Forecasting, channel’s requirement consolidation and merchandise allocation

- Vendor Managed Inventory initiative, automated ordering and CPFR initiative

- Merchandise financial tracking using SL interface with GL. Monitoring vis a vis purchasing budgets

- Manage the lifecycle of promotions, store openings, new product introductions, and other special events to improve promotions planning and execution

- Optimization for use of space—from a macro space level, and translating it into executable space plans for the highest possible return on inventory investment.

- Optimization of markdowns to maximize revenue and profit

- Create exception rules through a point and click interface for business issues like out–of–stock conditions, excessive forecast errors

- Module specific reports and Maintenance

Finance and Accounting (F&A):

- A standard Finance and Accounting Package/Application can be interfaced with the Retail Application modules delineated above. This F&A module needs the following capabilities

- Interface with POS Sales, Store Overheads, Misc Account

- AP,AR,GL and HO overheads

- Functionality of Working Capital Mngt. (including –ve working capital), Advertisement Expenses, Capital Investment amortization, depreciation

- Interface with HR (Human Resources) module for flow of HR and recruitment costs

- Module specific reports and Maintenance

Supply Chain Management:

- Third Party Logistics (TPL) vendor coordination and performance monitoring

- Inventory tracking and receipts vis a vis purchase orders

- Cross docking with mapping for supplier article interfacing

- Warehouse management with Pallet inspection, assortment creation and tagging facility

- Order – Receipt matching at Central Procurement office as well as channel/store level

- Actual Lead time capture matrix

- Create a network for receiving defective and excess products back from customers and supporting customers who have problems with delivered products

- Module specific reports and Maintenance

Customer Relationship (CR)

- Customer information capture for data analysis

- Point of Sale (POS) information Analysis & campaign management

- Point of Purchase Enhancement System

- Customer Feedback/complaints capture and implementation

- Loyalty Enhancement and Management system

- Module specific reports and maintenance

Human Resource Management (HRM)

- Time and labor management with scheduling and days of rotation

- Multiple means of entering time of work

- HR self services

- Payroll, configurable validations and approvals

- Learning management and advanced benefits

- Module specific reports and maintenance

Real Estate (RE)

- Decision Matrix for branch/store location and distribution center

- Lease/Ownership contracts information

- Amortization of Capital expenses and interface with Finance and Accounting module

- Repairs and value preservation

- Facilities Management

Data Warehouse and Business Intelligence

BI – Reporting Layer

- Financial KPI’s

- GMROII

- Turnover

- Inventory Days

- Working Capital

- Cash Flow

- Selling Cost

- Customer Performance

- Total Spend

- Average Transaction Value

- Items per ticket

- Frequency, Profitability

- Market Basket

- Product Performance

- Private Label v/s Branded

- GM

- Maintained GM

- Balance of Business

- Store Performance

- Sales per sq. ft.

- Stock Coverage

- Footfalls

- Conversion rate

- Average Transaction Value

- Items per ticket

- Shrinkage and Out of Stock

What is the Wheel of Retailing?

Definition:

The Wheel of Retailing is a theory to explain the institutional changes that take place when innovators enter the retail arena.

The Wheel of Retailing concept states that new types of retailers usually begin as low-margin, low-price, low-status operations, but later evolve into higher-priced, higher-service operations, eventually becoming like the conventional retailers they replaced.

Labels:

Retailing wheel,

wheel of retailing

Sam Walton's 10 Rules for Success

Rule #1

Commit to your business. Believe in it more than anything else. If you love your work, you’ll be out there every day trying to do the best you can, and pretty soon everybody around will catch the passion from you - like a fever.

Rule #2

Share your profits with all your associates, and treat them as partners. In turn, they will treat you as a partner, and together you will all perform beyond your wildest expectations.

Rule #3

Motivate your partners. Money and ownership aren’t enough. Set high goals, encourage competition and then keep score. Make bets with outrageous payoffs.

Rule #4

Communicate everything you possibly can communicate to your partners. The more they know, the more they’ll understand. The more they understand, the more they’ll care. Once they care, there will be no stopping in them. Information is power, and the gain you get from empowering your associates more than offsets the risk of informing your competitors.

Rule #5

Appreciate everything your associates do for the business. Nothing else can quite substitute for a few well-chosen, well-timed, sincere words of praise. They’re absolutely free and worth a fortune.

Rule #6

Celebrate your success and find humour in your failures. Don’t take yourself so seriously. Loosen up and everyone around you will loosen up. Have fun and always show enthusiasm. When all else fails put on a costume and sing a silly song.

Rule #7

Listen to everyone in your company, and figure out ways to get them talking. The folks on the front line - the ones who actually talk to customers - are the only ones who really know what’s going on out there. You’d better find out what they know.

Rule #8

Exceed your customer’s expectations. If you do they’ll come back over and over. Give them what they want - and a little more. Let them know you appreciate them. Make good on all your mistakes, and don't make excuses - apologize. Stand behind everything you do. ‘Satisfaction guaranteed’ will make all the difference.

Rule #9

Control your expenses better than your competition. This is where you can always find the competitive advantage. You can make a lot of mistakes and still recover if you run an efficient operation. Or you can be brilliant and still go out of business if you’re too inefficient.

Rule #10

Swim upstream. Go the other way. Ignore the conventional wisdom. If everybody is doing it one way, there’s a good chance you can find your niche by going exactly in the opposite direction.

E-Retailing

Internet Retailing or ‘e-retailing’ (less frequently also known as e-tailing) is basically an online shopping retail store using different technologies or media. It may be broadly be a combination of two elements.

» Combining new technologies with elements of traditional stores and direct mail models

» Using new technologies to replace elements of store or direct mail retail.

Internet retail also has some elements in common with direct mail retailing. For eg, e-mail messages can replace mail messages and the telephone, that are used in the direct mail model as means of providing information, communication and transactions while on-line catalogues can replace printed catalogues. As with direct mail businesses, critical success factors include:

• Use of customer databases

• Easy ordering

• Quick Delivery

Operational elements that the Internet retail model shares with both the retail store and direct mail model includes:

» Billing of customers

» Relationships with suppliers

There are, therefore, many elements that Internet retail and more traditional retail models have in common. Indeed many of the most successful Internet retailers have been those that have been able to successfully transfer critical elements from traditional retailing to the Internet, such as customer service and product displays.

Click on the image for enlarged view

Facts and Figures:

E-tailing accounts is about 10 per cent of the overall e-commerce market. According to the Internet and Mobile Association of India (IAMAI) and Indian Marketing Research Bureau (IMRB) report, the e-tailing market was worth Rs 850 crore in 2006-2007 and it is expected to grow by 30 per cent, touching Rs 1,105 crore in 2007-2008. Globally, the market for online shopping has increased by 40 per cent in the last two years, according to the latest Nielsen Global Online Survey on Internet shopping habits.

As a matter of fact, industry body Assocham has pointed out that the volume of products sold online are expected to grow by 150 per cent in 2008. Additionally, the increasing PC and Internet penetration is helping accelerate the share of e-commerce in India.

Advantages of E-tailing

* Sheer convenience.

* Wider choice.

* Better value.

* Unique gifting opportunity.

* Saves time and strain.

* Integrated source of information.

* Micro targeting.

* Mass personalization.

* Know customer preferences.

* No Real Estate Cost

E-Tailing Business Models

* Virtual Merchant

* Clicks & Mortar.

* Catalog Merchant.

* Online Malls.

* Manufacture Direct

Channel Comparison with Traditional Retailing Practices

Click on the image to see a clear view

Careers in Retail

Retail scenario in India

Overview:

Economic liberalization has brought about distinct changes in the life of urban people in India. A higher income group in middle class is emerging in the Indian society. Demographic changes have also made palpable changes in social culture and lifestyle. In this environment Indian Retail Industry is witnessing rapid growth. A.T. Kearney has ranked India as fifth in terms of Retail attractiveness. The industry has got tremendous potential but it also requires sufficient capital flow. Current Foreign Direct Investment policy of Indian Government does not allow any foreign direct investment in this sector however different global retail players are seriously eying on this market.

Industry Characteristics:

Indian Retail Industry is the largest employer after Agriculture (around 8% of the population) and it has the highest outlet density in the world however this industry is still in a very nascent stage. The whole market is mostly unorganized and it is dominated by fragmented Kirana stores. A poor, supply chain and backward integration has weakened the whole process. Organized corporate retailers contribute only a negligible percentage of the overall retail business. Organized and trained Retail workforce is not available in India and the overall skill level is low mainly because of the low maturity level of the Industry.

Business Opportunities

However India can unveil significant business opportunity to the Retailers. Indian retail sector is estimated to have a total market size of $180 Billion. A. McKinsey report on India says, "Organized retailing would increase the efficiency and productivity of entire gamut of economic activities, and would help in achieving higher GDP growth".

The factors responsible for the development of the Retail sector in India can be broadly summarized as follows:

1. Rising incomes and improvements in infrastructure are enlarging consumer markets and accelerating the convergence of consumer tastes. Looking at income classification, the National Council of Applied Economic Research (NCAER) classified approximately 50% of the Indian population as low income in 1994-95; this is expected to decline to 17.8% by 2006-07.

2. Liberalization of the Indian economy which has led to the opening up of the market for consumer goods has helped the MNC brands like Kellogs, Unilever, Nestle, etc. to make significant inroads into the vast consumer market by offering a wide range of choices to the Indian consumers.

3. Also Shift in consumer demand to foreign brands like McDonalds, Sony, Panasonic, etc.

Major Retail Players in India:

| Retailers | Current turn over (in Crore) |

| Pantaloon RPG Shopper Stop Life Style Westside Ebony Piramyd | 700 550 400 230 120 85 72 |

Information Technology (IT) in Retail

Why information technology IT is needed?

Information Technology (IT) has become a key business driver in today’s world. Retailers are also trying to reap in the benefits of the technology. Thus technology has become a critical and competitive tool for surviving in the business. Retailers are using software systems to manage and plan their inventory, to reduce the procurement costs, electronic ordering, electronic fund transfer, e mail communication and for many other things. IT is poised to take a much bigger role in Retail Industry however the high implementation cost of IT projects has restricted many Retailers to go for proper IT solution. IT growth areas in Retail are mentioned below.

Supply Chain Management:

Supply chain is one of the focus areas for the Retailers and immense opportunity of business process improvement and scope of technological empowerment is there in this area. In today’s tough economic climate customers have become price sensitive and there is a price draught in the market . Retailers are struggling to control the cost and in this the environment effective Supply Chain Management can act as a big contributor. It helps them to integrate with their suppliers and through collaborative planning retailers can reduce the cost. SCM solutions will enable Retailers to track their inventory movement from supplier’s premises to the point of sale. It gives a better visibility in the area of demand planning, forecasting and inventory management. Worlds largest Retailer Wal–Mart has adopted a state of the art SCM system which not only tracks the inventory but also it increases the efficiency of the process. Wal–Mart has also introduced the Radio Frequency Identification (RFID) of merchandise.

CRM:

CRM continues to be a growth area for IT in Retail sector. Advancement in this field helps to maintain sophisticated customer database and systems that can maximize multi channel returns. This helps the retailers to understand the customers demand pattern and enables them to offer a tailor made shopping experience.

Internet:

Internet has unfolded lot of opportunities to the Retailers. Retailers can do business over internet. It can also be used as a communication medium. Successful Retail community uses internet technology for reliable communication between Retailers, customers and suppliers.

Business Intelligence:

Business Intelligence is an effective analytical tool which helps the Retailers to understand the eco system of retail business . It helps the business community to take mission critical business decisions which will help them to navigate in the right direction. In today’s world Retailers equipped with such data mining or data warehousing tool which has the micro level understanding of customer demand.

Strategies in Retail

A business firm cannot travel in an unplanned way. To encounter the business challenges in a highly competitive environment and to find out a sustainable growth road map Retailers need to realize the importance of strategic planning. Strategic planning can be viewed as a stream of decisions and activities which lead to Effective business strategies which help the organization to fulfill its objectives.

Retail landscape is changing rapidly and in this changing economic environment Retailers need to find out the right strategy, which will help them to cope up with the environment and empowers them to take right decisions for the future. Adopting correct strategy will help the Retailers to optimize their resources and also it will give an edge over its competitors. Margin and Turnover are the two important Industry and the Retail operations can be classified into four groups/quadrants.

i) High Margin and High Turnover eg. a convenience food store

ii) Low Margin and High Turnover eg. a discount store

iii) Low Margin Low Turnover eg. a dying business

iv) High Margin Low Turnover eg. an up market specialty store.

Retail business needs to formulate the suitable strategy after considering its strengths and weaknesses. Hence SWOT analysis will be an effective tool in determining the correct strategy for the particular category of retail business.

Some of the strengths and weaknesses of the Retail industry are outlined below.

Strengths :

These are the areas on which success stories have been built and therefore retailers need to capitalize on that.

i) Supremacy of Discount store

ii) Advancement in the area of Information Technology

iii) New sales channels like E-commerce and direct marketing

iv) Availability of consumer credit. Explosion of financial institutions

Weakness:

i) Slow performance of Chain Stores

ii) Advent of Category Killers

Opportunities:

i) Brick and click: A combination of traditional store retailing along with non store retailing like Internet and E-commerce.

ii) Premium Priced Store: Premium priced stores are targeting the high income group customers and earning healthy profits . Tiffany and Co is an example of such premium priced store.

iii) Entertainment in Retail: Entertainment Industry and Retail Industry are working hand in hand to attract larger section of consumers. Sony Corporation has opened some huge entertainment complexes in USA and so many retail outlets are also housed in the same building. These two outlets competate each other and hence both are doing are doing well.

Threats:

i) Demise of Independent small stores

ii) Demographic Changes

Characteristics of Retail Industry

Retail Industry: Small to huge store

The spectrum of Retail Industry is quite wide in nature. Retail serves consumers through a small grocery store to a huge departmental store. Retail Industry is heavily dependent on consumer spending. In fact 2/3 of US GDP is coming from Retail business. Retail is the second largest industry in US. It has employed 23 Million people. During economic slow down consumer spending decreases and it poses threat to the Retail industry. Consumers confidence is one of the key drivers of the industry.

Decline in Small Stores

It is observed that small independently owned stores are gradually loosing their foothold in the market place. These stores are generally called “Mom and Pop” stores and they offer limited merchandise to the consumer. These store are facing stiff competition from the large departmental stores or superstores and in this process they are closing down their shutters. In many locations the arrival of a superstore has forced nearby independents out of business. In the book selling business Barnes & Noble superstore or Borders Books and music usually puts smaller bookstores out of business. This is a major characteristic prevailing worldwide. But it is also true that many small independent outlets still thrive by knowing their customers better and providing them with more personalized service.

Internet and E-Commerce

Internet, the ubiquitous medium has opened a new avenue in front of the Retailers. It has offered an opportunity to the consumers to shop from the home. As it stands today overall Retail sales through internet may not be that significant but gradually it is gaining popularity amongst consumers. Amazon.com is successful in this E-commerce domain.

Repositioning of Departmental Stores

The appeal of big departmental store is in the wane and they are trying to reposition themselves. They are repositioning their product lines to survive in this highly competitive market.For example, A departmental stores which is supplying general merchandise to the consumer is changing themselves to a giant apparel store.

Rise in Discount stores

Supremacy of Discount store is also one of the distinct characteristics of Retail Industry today. Discount stores offer money back guarantee, every day low price etc. to lure customers. They also provide floor help and easy access to the merchandise to facilitate the consumer. Wal-Mart the worlds largest Retailer comes under this category of Retail store.

Category Killers

There are Retailers who actually concentrate on one particular product category and grab a lion’s share of that market and outperform their competitors. They are called Category Killers. Toys R Us (Toy market), Home Depot (Home Improvement), Staples (Office Supplies) are the examples of such Retailers who have grabbed a major market share in that product category and they have forced a reduction in the number of players in that product segment. This is also a distinct trend observed in the current Retail market. Ten years back there were number of players in the toy market and no one was controlling more than 5% of market share but now the number of players has come down to six and Toys R Us is enjoying 20% market share.

Direct Marketing

With the advancement of technology, Retailers have found another sales channel through which they can reach the consumer and this is known as direct marketing. Direct marketing has their root in direct mail and catalog marketing (Land’s End and LL Bean). It includes telemarketing, television direct response marketing (Home shopping network, QVC). Although an overwhelming majority of goods and services is sold through stores and non store which indicates Retailing is growing at a faster rate. Direct selling worth about $9 Billion industry with around 600 companies selling door to door. Avon, Electrolux, Southwestern company, Tupperware and Mary key cosmetics are the examples who have adopted this strategy successfully.

Demographic Changes

Retail industry is impacted by the demographic changes. As a result of this change taste of the consumer is undergoing a change and it creates a demand for certain products. World wide Retailers are keeping a close watch on this change and they are trying to realign themselves with this change.

Mergers and Acquisitions

Retailers who want to dominate the market place have adopted the strategy of mergers and acquisitions. This is also one of the distinct trends in Global Retail Industry today. Instead of achieving an organic growth Retailers can grow significantly with the help of mergers and acquisitions. This helps them to occupy more shelf space in the market place. As the volume increases they are establishing better control over their suppliers and they are reducing the procurement cost and in that way they are boosting their profitability. This is driven by the economic growth factors, size, revenue pattern and the customer demand. Sears and Land’s End merger is one of the significant mergers which has happened in recent times. Another important example would be Nikes acquisition of Hurley, a well known surfing brand. This has helped Nike to enter in to a new market segment.

Type of Retailers

Retail Organizations have shown great variety and different format of stores which are coming up quite rapidly. Generally Retailers can be of six types.

1.Specialty Store

This store is characterized by narrow product lines but with deep assortments such as Apparel Store, Sporting goods store, Furniture store, Florist and Book store. Under this also there could be specializations like limited line store (eg. Men’s clothing store) and Super specialty store (eg. Men’s custom shirt store). Examples of such stores are Athlete’s foot, Tall men.

2.Departmental Store

Deparmental store has Several Product Lines – typically clothing, home furnishing and household goods with each line operated as a separate department managed by specialist buyers and merchandisers. Examples are such as Sears, JC Penny, Nordstrom.

3.Supermarkets

Relatively large, low cost, low margin high volume, self service operation which is designed to cater total needs for food, laundry, household maintenance products. Supermarkets earn an average profit of only 1 percent on sales. Example: Safeway, Kroger and more.

4.Convenience Store

These are the stores which are relatively small in size and they are located near residential area, normally remains open seven days a week and carrying a limited line of high turnover convenience products at slightly high prices. Many have added take away sandwiches, coffee and pastries. Examples: 7-Eleven ,Circle K

5.Discount Stores

Standard merchandise sold at lower prices with lower margin but higher volumes. Actual discount stores regularly sell merchandise at lower prices and offer mostly national brands. In Discount retailing, Discount specialty retailing is also present Such as discount electronic store or discount book store. Examples: Wal- Mart (all purpose discount store), Kmart. For Specialty store: Crown Bookstore.

6.Off Price Retailers

Merchandise bought at less than regular wholesale prices and sold at less than retail prices. Often left over goods, irregulars are obtained at reduced prices from manufacturers and other retailers. Factory outlets are owned and operated by manufacturers and they normally carry manufacturer’s surplus, discontinued and irregular goods. Examples: Mikasa (Dinnerware) and Dexter(Shoes).

What is Retailing? What is Retail?

Retail

Retail is derived from French word retaillier which means cut off a piece or to break bulk. Retail is a sale of commodities or goods in a small quality directly to the customers.

Who is a Retailer?

Retailer are those who buy goods in a large quantity from the market or a dealer and sold again in the market at lesser quantity directly to the consumers. Retail happens in the shop or store. Retailers are at the ens of supply chain. Retailers also indicates service provider services which needs larger number of individuals such as public utility services.

Retailing

A last stage in movement of goods/services to consumer. Retailing consists of all activities involved in marketing of goods/services to consumers for their personal, family or household use. Retailing is the business where an organization directly sells its products and services to an end consumer and this is for his personal use. By definition whenever an organization be it a manufacturing or a whole seller sells directly to the end consumer it is actually operating in the Retail space. This industry has traveled a long way from a humble beginning to a situation where worldwide Retail sales is more than $7 Trillion.

Retailing has played a vital role worldwide in increasing productivity across a wide range of consumer goods and services. The impact can be best felt in countries like USA, UK, Mexico, Thailand and more recently in China. Economies of countries like Singapore, Hong Kong and Malaysia are also heavily boosted by the Retail Industry.

It is a changing industry and old traditional ways of doing business has lost relevance nowadays. It is an industry which is heavily dependent on consumer spending. In this ecosystem consumers play the most important role. As a result of this, Retailers are continuously challenging themselves to find out ways and means of identifying customers need. They are busy in devising new strategies to have an atomic level understanding of consumer demand.

Indian retail Vs World retail

India vs. World:

Indian retail is fragmented with over 12 million outlets operating in the country. This is in comparison to 0.9 million outlets in USA, catering to more than 13 times of the total retail market size as compared to India .

India has the highest number of outlets per capita in the world - widely spread retail network but with the lowest per capita retail space (@ 2 sq. ft. per person) .

Annual turnover of Wal-Mart (Sales in 2001 were $219 billion) is higher than the size of Indian retail industry. Almost 100 times more than the turnover of HLL (India's largest FMCG company).

Wal-Mart - over 4,800 stores (over 47 million square meters) where as none of India's large format store (Shoppers' Stop, Westside, Lifestyle) can compare.

The sales per hour of $22 million are incomparable to any retailer in the world. Number of employees in Wal-Mart are about 1.3 million where as the entire Indian retail industry employs about three million people.

One-day sales record at Wal-Mart (11/23/01) $1.25 billion - roughly two third of HLL's annual turnover.

Developed economies like the U.S. employ between 10 and 11 percent of their workforce in retailing (against 7 percent employed in India today).

60% of retailers in India feel that the multiple format approach will be successful here whereas in US 34 of the fastest-growing 50 retailers have just one format

Inventory turns ratio: measures efficiency of operations. The U.S. retail sector has an average inventory turns ratio of about 18. Many Indian retailers KPMG surveyed have inventory turns levels between 4 and 10.

Global best-practice retailers can achieve more than 95 percent availability of all SKUs on the retail shelves (translating into a stock-out level of less than 5 %).The stock-out levels among Indian retailers surveyed ranged from 5 to 15 percent.

Indian retail is fragmented with over 12 million outlets operating in the country. This is in comparison to 0.9 million outlets in USA, catering to more than 13 times of the total retail market size as compared to India .

India has the highest number of outlets per capita in the world - widely spread retail network but with the lowest per capita retail space (@ 2 sq. ft. per person) .

Annual turnover of Wal-Mart (Sales in 2001 were $219 billion) is higher than the size of Indian retail industry. Almost 100 times more than the turnover of HLL (India's largest FMCG company).

Wal-Mart - over 4,800 stores (over 47 million square meters) where as none of India's large format store (Shoppers' Stop, Westside, Lifestyle) can compare.

The sales per hour of $22 million are incomparable to any retailer in the world. Number of employees in Wal-Mart are about 1.3 million where as the entire Indian retail industry employs about three million people.

One-day sales record at Wal-Mart (11/23/01) $1.25 billion - roughly two third of HLL's annual turnover.

Developed economies like the U.S. employ between 10 and 11 percent of their workforce in retailing (against 7 percent employed in India today).

60% of retailers in India feel that the multiple format approach will be successful here whereas in US 34 of the fastest-growing 50 retailers have just one format

Inventory turns ratio: measures efficiency of operations. The U.S. retail sector has an average inventory turns ratio of about 18. Many Indian retailers KPMG surveyed have inventory turns levels between 4 and 10.

Global best-practice retailers can achieve more than 95 percent availability of all SKUs on the retail shelves (translating into a stock-out level of less than 5 %).The stock-out levels among Indian retailers surveyed ranged from 5 to 15 percent.

Major Retailers

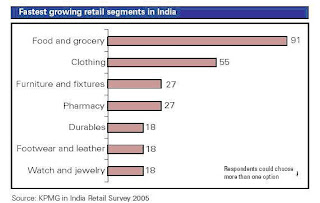

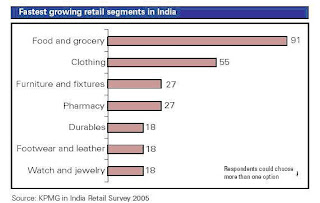

India’s top retailers are largely lifestyle, clothing and apparel stores.

This is followed by grocery stores.

Following the past trends and business models in the west retail giants such as Pantaloon, Shoppers’ Stop and Lifestyle are likely to target metros and small cities almost doubling their current number of stores.

These Walmart wannabes have the economy of scale to be low –medium cost retailers pocketing narrow margin.

This is followed by grocery stores.

Following the past trends and business models in the west retail giants such as Pantaloon, Shoppers’ Stop and Lifestyle are likely to target metros and small cities almost doubling their current number of stores.

These Walmart wannabes have the economy of scale to be low –medium cost retailers pocketing narrow margin.

Recent Trends

Traditionally three factors have plagued the retail industry:

Unorganized : Vast majority of the twelve million stores are small "father and son" outlets

Fragmented : Mostly small individually owned businesses, average size of outlet equals 50 s.q. ft. Though India has the highest number of retail outlets per capita in the world, the retail space per capita at 2 s.q. ft per person is amongst the lowest.

Rural bias: Nearly two thirds of the stores are located in rural areas. Rural retail industry has typically two forms: "Haats" and “Melas". Haats are the weekly markets : serve groups of 10-50 villages and sell day-to-day necessities. Melas are larger in size and more sophisticated in terms of the goods sold (like TVs)

Recent changes:

Experimentation with formats: Retailing in India is still evolving and the sector is witnessing a series of experiments across the country with new formats being tested out. Ex. Quasi-mall, sub-urban discount stores, Cash and carry etc.

Store design : Biggest challenge for organised retailing to create a “customer-pull” environment that increases the amount of impulse shopping. Research shows that the chances of senses dictating sales are upto 10-15%. Retail chains like MusicWorld, Baristas, Piramyd and Globus are laying major emphasis & investing heavily in store design.

Emergence of discount stores: They are expected to spearhead the organised retailing revolution. Stores trying to emulate the model of Wal-Mart. Ex. Big Bazaar, Bombay Bazaar, RPGs.

Unorganized retailing is getting organized: To meet the challenges of organized retailing such as large cineplexes, and malls, which are backed by the corporate house such as 'Ansals' and 'PVR‘ the unorganized sector is getting organized. 25 stores in Delhi under the banner of Provision mart are joining hands to combine monthly buying. Bombay Bazaar and Efoodmart formed which are aggregations of Kiranas.

Multiple drivers leading to a consumption boom:

-Favorable demographics

-Growth in income

-Increasing population of women

-Raising aspirations : Value added goods sales

Food and apparel retailing key drivers of growth.

Organized retailing in India has been largely an urban phenomenon with affluent classes and growing number of double-income households.

More successful in cities in the south and west of India. Reasons range from differences in consumer buying behavior to cost of real estate and taxation laws.

Rural markets emerging as a huge opportunity for retailers reflected in the share of the rural market across most categories of consumption

-ITC is experimenting with retailing through its e-Choupal and Choupal Sagar – rural hypermarkets.

-HLL is using its Project Shakti initiative – leveraging women self-help groups – to explore the rural market.

-Mahamaza is leveraging technology and network marketing concepts to act as an aggregator and serve the rural markets.

IT is a tool that has been used by retailers ranging from Amazon.com to eBay to radically change buying behavior across the globe.

‘e-tailing’ slowly making its presence felt.

Companies using their own web portal or tie-sups with horizontal players like Rediff.com and Indiatimes.com to offer products on the web.

Unorganized : Vast majority of the twelve million stores are small "father and son" outlets

Fragmented : Mostly small individually owned businesses, average size of outlet equals 50 s.q. ft. Though India has the highest number of retail outlets per capita in the world, the retail space per capita at 2 s.q. ft per person is amongst the lowest.

Rural bias: Nearly two thirds of the stores are located in rural areas. Rural retail industry has typically two forms: "Haats" and “Melas". Haats are the weekly markets : serve groups of 10-50 villages and sell day-to-day necessities. Melas are larger in size and more sophisticated in terms of the goods sold (like TVs)

Recent changes:

Experimentation with formats: Retailing in India is still evolving and the sector is witnessing a series of experiments across the country with new formats being tested out. Ex. Quasi-mall, sub-urban discount stores, Cash and carry etc.

Store design : Biggest challenge for organised retailing to create a “customer-pull” environment that increases the amount of impulse shopping. Research shows that the chances of senses dictating sales are upto 10-15%. Retail chains like MusicWorld, Baristas, Piramyd and Globus are laying major emphasis & investing heavily in store design.

Emergence of discount stores: They are expected to spearhead the organised retailing revolution. Stores trying to emulate the model of Wal-Mart. Ex. Big Bazaar, Bombay Bazaar, RPGs.

Unorganized retailing is getting organized: To meet the challenges of organized retailing such as large cineplexes, and malls, which are backed by the corporate house such as 'Ansals' and 'PVR‘ the unorganized sector is getting organized. 25 stores in Delhi under the banner of Provision mart are joining hands to combine monthly buying. Bombay Bazaar and Efoodmart formed which are aggregations of Kiranas.

Multiple drivers leading to a consumption boom:

-Favorable demographics

-Growth in income

-Increasing population of women

-Raising aspirations : Value added goods sales

Food and apparel retailing key drivers of growth.

Organized retailing in India has been largely an urban phenomenon with affluent classes and growing number of double-income households.

More successful in cities in the south and west of India. Reasons range from differences in consumer buying behavior to cost of real estate and taxation laws.

Rural markets emerging as a huge opportunity for retailers reflected in the share of the rural market across most categories of consumption

-ITC is experimenting with retailing through its e-Choupal and Choupal Sagar – rural hypermarkets.

-HLL is using its Project Shakti initiative – leveraging women self-help groups – to explore the rural market.

-Mahamaza is leveraging technology and network marketing concepts to act as an aggregator and serve the rural markets.

IT is a tool that has been used by retailers ranging from Amazon.com to eBay to radically change buying behavior across the globe.

‘e-tailing’ slowly making its presence felt.

Companies using their own web portal or tie-sups with horizontal players like Rediff.com and Indiatimes.com to offer products on the web.

Retail Theft and Inventory Shrinkage

Retail Theft:

Employee theft

Shoplifting

Vendor fraud

Administrative error

Statistics:

2007 Losing $43 Billion to Theft

1.7% of their total annual sales

Last year - Losing $49.5 billion to Theft

Where Inventory Shrinkage Happens:

What's the Harm?

Impacts everyone especially Consumers

Average family of four : > $440 this year in higher prices because of inventory theft

Theft’s Target: hot selling items on the holiday shopping season

Employee theft

Shoplifting

Vendor fraud

Administrative error

Statistics:

2007 Losing $43 Billion to Theft

1.7% of their total annual sales

Last year - Losing $49.5 billion to Theft

Where Inventory Shrinkage Happens:

What's the Harm?

Impacts everyone especially Consumers

Average family of four : > $440 this year in higher prices because of inventory theft

Theft’s Target: hot selling items on the holiday shopping season

Rural Retailing

Rural Retailing:

India's huge rural population has caught the eye of the retailers looking for new areas of growth. ITC launched India's first rural mall "Chaupal Saga" offering a diverse range of products from FMCG to electronic goods to automobiles, attempting to provide farmers a one-stop destination for all their needs." Hariyali Bazar" is started by DCM Sriram group which provides farm related inputs & services. The Godrej group has launched the concept of 'agri-stores' named "Adhaar" which offers agricultural products such as fertilizers & animal feed along with the required knowledge for effective use of the same to the farmers. Pepsi on the other hand is experimenting with the farmers of Punjab for growing the right quality of tomato for its tomato purees & pastes.

India's huge rural population has caught the eye of the retailers looking for new areas of growth. ITC launched India's first rural mall "Chaupal Saga" offering a diverse range of products from FMCG to electronic goods to automobiles, attempting to provide farmers a one-stop destination for all their needs." Hariyali Bazar" is started by DCM Sriram group which provides farm related inputs & services. The Godrej group has launched the concept of 'agri-stores' named "Adhaar" which offers agricultural products such as fertilizers & animal feed along with the required knowledge for effective use of the same to the farmers. Pepsi on the other hand is experimenting with the farmers of Punjab for growing the right quality of tomato for its tomato purees & pastes.

STRENGTH AND WEAKNESS OF RETAILING

STRENGTH:

1. Retailing is a "Technology-intensive" industry. It is technology that will help the organized retailers to score over the unorganized retailers. Successful organized retailers today work closely with their vendors to predict consumer demand, shorten lead times, reduce inventory holding and ultimately save cost. Example: Wal-Mart pioneered the concept of building competitive advantage through distribution & information systems in the retailing industry. They introduced two innovative logistics techniques – cross-docking and EDI (electronic data interchange)

2. On an average a super market stocks up to 5000 SKU's against a few hundreds stocked with an average unorganized retailer. This will provide variety in products(required breadth & depth for consumers)

3. As a consequence of high volumes, procurement will be direct from the Manufacturer. Hence, merchandise can be offered at lower costs.

WEAKNESS :

1. Less Conversion level : Despite high footfalls, the conversion ratio has been very low in the retail outlets in a mall as compared to the standalone counter parts. It is seen that actual conversions of footfall into sales for a mall outlet is approximately 20-25%. On the other hand, a high street store of retail chain has an average conversion of about 50-60%. As a result, a stand-alone store has a ROI (return on investment) of 25-30%; in contrast the retail majors are experiencing a ROI of 8-10%

2. Customer Loyalty: Retail chains are yet to settle down with the proper merchandise mix for the mall outlets. Since the stand-alone outlets were established long time back, so they have stabilized in terms of footfalls & merchandise mix and thus have a higher customer loyalty base.

1. Retailing is a "Technology-intensive" industry. It is technology that will help the organized retailers to score over the unorganized retailers. Successful organized retailers today work closely with their vendors to predict consumer demand, shorten lead times, reduce inventory holding and ultimately save cost. Example: Wal-Mart pioneered the concept of building competitive advantage through distribution & information systems in the retailing industry. They introduced two innovative logistics techniques – cross-docking and EDI (electronic data interchange)

2. On an average a super market stocks up to 5000 SKU's against a few hundreds stocked with an average unorganized retailer. This will provide variety in products(required breadth & depth for consumers)

3. As a consequence of high volumes, procurement will be direct from the Manufacturer. Hence, merchandise can be offered at lower costs.

WEAKNESS :

1. Less Conversion level : Despite high footfalls, the conversion ratio has been very low in the retail outlets in a mall as compared to the standalone counter parts. It is seen that actual conversions of footfall into sales for a mall outlet is approximately 20-25%. On the other hand, a high street store of retail chain has an average conversion of about 50-60%. As a result, a stand-alone store has a ROI (return on investment) of 25-30%; in contrast the retail majors are experiencing a ROI of 8-10%

2. Customer Loyalty: Retail chains are yet to settle down with the proper merchandise mix for the mall outlets. Since the stand-alone outlets were established long time back, so they have stabilized in terms of footfalls & merchandise mix and thus have a higher customer loyalty base.

RURAL VS URBAN RETAIL TRENDS

RURAL VS URBAN RETAIL TRENDS:

India's largely rural population has also caught the eye of retailers looking for new areas of growth. ITC launched the country's first rural mall ‘ Chaupal Sagar' , offering a diverse product range from FMCG to electronics appliance to automobiles, attempting to provide farmers a one-stop destination for all of their needs. There has been yet another initiative by the DCM Sriram Group called the ‘ Hariyali Bazaar' , that has initially started off by providing farm related inputs and services but plans to introduce the complete shopping basket in due course. Other corporate bodies include Escorts, and Tata Chemicals (with Tata Kisan Sansar) setting up agri-stores to provide products/services targeted at the farmer in order to tap the vast rural market.

Commenting on the Rural Retailing chapter in INDIA RETAIL REPORT 2005, Mr. Adi B. Godrej, Chairman, The Godrej Group (India's one of the leading corporate majors) said that his group had also launched the concept of agri-stores named 'Adhaar', which served as one-stop shops for farmers selling agricultural products such as fertilisers & animal feed and also providing farmers knowledge on how to effectively utilise these products. "There are 8 stores already operating in Maharashtra and Gujarat and further expansion is very much on the cards. he added.

FDI could indeed do a lot in this sector as entry of international retailers would bring in the required expertise to set the supply chain in place which would result in elimination of wastage, better prices and quality for consumers and higher income for farmers besides of course farm produce retailing getting a facelift, said Mr. Godrej.

Tapping the fresh farm produce sector, the group plans to take its recently launched retail concept – Nature's Basket - to newer cities steadily. Godrej Group's Agro and Food division, Godrej Agrovet Ltd. (GAVL) operates the format, selling a variety of vegetables, fruits and herbs - both local and exotic thereby introducing the concept of 'farm-to-plate' to urbanites. Godrej plans to open four more Nature's Basket stores in Mumbai before taking them national. Setting up cost of a store is about INR 5-10 million and per stores sales are expected in the range of INR 30- Rs 50 million a year.

Interestingly, the world's largest corporation, Wal-mart, also had its roots in rural America. Unlike many other retailers who started from urban centres and then trickled down to rural areas, Wal-mart had started from rural areas and then came closer to cities over a period of time. Many more such concepts are likely to be tested in the future as marketers and retailers begin to acknowledge that the rural consumer is more than a ‘poor cousin' of the urban counterpart. The IMAGES KSA Report avers that these concepts are likely to go a long way in bringing a huge untapped population within the purview of organized retailing, thereby, increasing the size of the total market

The above chart makes it clearly evident why the rural retail market has been attracting the big giants to invest in it.

URBAN TRENDS :

The urban retailing has been experimenting with many formats like the supermarkets, hypermarkets, specialty stores, multi branded outlets etc. and of latest it seems to be embracing the trend of mall culture. It is a rich man's world too, with multi-screen cinemas, restaurants, games and branded shops - well out of the reach of many of the country's one billion people. But India's middle-classes, widely travelled and with deep pockets, are flocking to malls.

India's largely rural population has also caught the eye of retailers looking for new areas of growth. ITC launched the country's first rural mall ‘ Chaupal Sagar' , offering a diverse product range from FMCG to electronics appliance to automobiles, attempting to provide farmers a one-stop destination for all of their needs. There has been yet another initiative by the DCM Sriram Group called the ‘ Hariyali Bazaar' , that has initially started off by providing farm related inputs and services but plans to introduce the complete shopping basket in due course. Other corporate bodies include Escorts, and Tata Chemicals (with Tata Kisan Sansar) setting up agri-stores to provide products/services targeted at the farmer in order to tap the vast rural market.

Commenting on the Rural Retailing chapter in INDIA RETAIL REPORT 2005, Mr. Adi B. Godrej, Chairman, The Godrej Group (India's one of the leading corporate majors) said that his group had also launched the concept of agri-stores named 'Adhaar', which served as one-stop shops for farmers selling agricultural products such as fertilisers & animal feed and also providing farmers knowledge on how to effectively utilise these products. "There are 8 stores already operating in Maharashtra and Gujarat and further expansion is very much on the cards. he added.

FDI could indeed do a lot in this sector as entry of international retailers would bring in the required expertise to set the supply chain in place which would result in elimination of wastage, better prices and quality for consumers and higher income for farmers besides of course farm produce retailing getting a facelift, said Mr. Godrej.

Tapping the fresh farm produce sector, the group plans to take its recently launched retail concept – Nature's Basket - to newer cities steadily. Godrej Group's Agro and Food division, Godrej Agrovet Ltd. (GAVL) operates the format, selling a variety of vegetables, fruits and herbs - both local and exotic thereby introducing the concept of 'farm-to-plate' to urbanites. Godrej plans to open four more Nature's Basket stores in Mumbai before taking them national. Setting up cost of a store is about INR 5-10 million and per stores sales are expected in the range of INR 30- Rs 50 million a year.

Interestingly, the world's largest corporation, Wal-mart, also had its roots in rural America. Unlike many other retailers who started from urban centres and then trickled down to rural areas, Wal-mart had started from rural areas and then came closer to cities over a period of time. Many more such concepts are likely to be tested in the future as marketers and retailers begin to acknowledge that the rural consumer is more than a ‘poor cousin' of the urban counterpart. The IMAGES KSA Report avers that these concepts are likely to go a long way in bringing a huge untapped population within the purview of organized retailing, thereby, increasing the size of the total market

The above chart makes it clearly evident why the rural retail market has been attracting the big giants to invest in it.

URBAN TRENDS :

The urban retailing has been experimenting with many formats like the supermarkets, hypermarkets, specialty stores, multi branded outlets etc. and of latest it seems to be embracing the trend of mall culture. It is a rich man's world too, with multi-screen cinemas, restaurants, games and branded shops - well out of the reach of many of the country's one billion people. But India's middle-classes, widely travelled and with deep pockets, are flocking to malls.

COMPETITION FROM CONVENTIONAL RETAILING

COMPETITION FROM CONVENTIONAL RETAILING:

· At any point of time, even though any number of players enter into this sector, their reach will be limited when compared to the conventional stores.

· It is very difficult for these national players to render special service and reach the consumers as that of conventional stores.

· Credit facility can be availed at the convenience store. But not in the case of malls and hypermarkets.

· Home delivery can be availed from convenience stores since they focus on servicing smaller localities. The new generation retail outlets can also provide the same but it may not be feasible when considering the huge population and also their ever changing order size.

· The Conventional stores have some more intangible factors like the human touch which makes the customers feel more valuable.

· These above mentioned points add huge strength to the conventional and traditional Kirana stores. They will be a tough competition for the new generation organized retailers. The conventional retailers are competitive enough in the market and can easily sustain at any point of time.

· The only change that may happen is a part of the revenues of the conventional stores could be taken away by the new organized retailers.

· They can renovate and come back. For eg: HLL Super value stores.

In the midst of a raging debate on the fate of local kirana stores in the face of the fast emerging modern organised retail industry, Hindustan Lever Ltd (HLL) has embarked on a project that could give modern retailers a run for their money.

According to HLL, the `Super Value Store' Programme will exclusively target mom-n-pop stores by refashioning them to look like modern retail outlets. Apart from buying shelf space and in turn giving the retailer a three per cent discount on its products, HLL would also impart retail training and solutions to help shopkeepers add value to help them keep pace with changing times.

The programme, in fact, has already started reaping its benefits. According to the owner of a South Delhi-based mom-n-pop store that is one of the programme's beneficiaries, "We have already seen a surge of 20 per cent in sales due to the programme initiated by HLL. Over and above, the shop also saves up to Rs 5,000-6,000 due to the scheme."

According to industry sources, HLL's Super Value programme is slated to service around 15,000-20,000 mom-n-pop stores.

· There might be entry of some B2B companies in the market, where they buy goods in huge volumes and sell it to retailers at a price almost equivalent to the price what these national retail giants are going to sell.

· There is every chance for the conventional retailers to form a Consortium which helps them to enjoy the same margins as those of the organized giants. This has already been proved to be possible by the South African conventional retailers.

· Another option is that the national giants like Reliance Retail may enter the space of the wholesale market and give higher margins for these smaller retailers for bulk purchases. And this in turn helps the conventional stores to enjoy equal margins as those of the other smaller organized retailers.

HLL may not differentiate the conventional stores in terms of margins, because the existing conventional retail chain for such a big company is like its own arms. And if the company is going to differentiate the conventional stores in terms of margins then it would be similar to chopping its own arms because the conventional retailers may start purchasing from giants like Reliance Retail who may provide higher margins as mentioned in the above point.

· At any point of time, even though any number of players enter into this sector, their reach will be limited when compared to the conventional stores.

· It is very difficult for these national players to render special service and reach the consumers as that of conventional stores.

· Credit facility can be availed at the convenience store. But not in the case of malls and hypermarkets.

· Home delivery can be availed from convenience stores since they focus on servicing smaller localities. The new generation retail outlets can also provide the same but it may not be feasible when considering the huge population and also their ever changing order size.

· The Conventional stores have some more intangible factors like the human touch which makes the customers feel more valuable.

· These above mentioned points add huge strength to the conventional and traditional Kirana stores. They will be a tough competition for the new generation organized retailers. The conventional retailers are competitive enough in the market and can easily sustain at any point of time.

· The only change that may happen is a part of the revenues of the conventional stores could be taken away by the new organized retailers.

· They can renovate and come back. For eg: HLL Super value stores.

In the midst of a raging debate on the fate of local kirana stores in the face of the fast emerging modern organised retail industry, Hindustan Lever Ltd (HLL) has embarked on a project that could give modern retailers a run for their money.

According to HLL, the `Super Value Store' Programme will exclusively target mom-n-pop stores by refashioning them to look like modern retail outlets. Apart from buying shelf space and in turn giving the retailer a three per cent discount on its products, HLL would also impart retail training and solutions to help shopkeepers add value to help them keep pace with changing times.

The programme, in fact, has already started reaping its benefits. According to the owner of a South Delhi-based mom-n-pop store that is one of the programme's beneficiaries, "We have already seen a surge of 20 per cent in sales due to the programme initiated by HLL. Over and above, the shop also saves up to Rs 5,000-6,000 due to the scheme."

According to industry sources, HLL's Super Value programme is slated to service around 15,000-20,000 mom-n-pop stores.

· There might be entry of some B2B companies in the market, where they buy goods in huge volumes and sell it to retailers at a price almost equivalent to the price what these national retail giants are going to sell.

· There is every chance for the conventional retailers to form a Consortium which helps them to enjoy the same margins as those of the organized giants. This has already been proved to be possible by the South African conventional retailers.

· Another option is that the national giants like Reliance Retail may enter the space of the wholesale market and give higher margins for these smaller retailers for bulk purchases. And this in turn helps the conventional stores to enjoy equal margins as those of the other smaller organized retailers.

HLL may not differentiate the conventional stores in terms of margins, because the existing conventional retail chain for such a big company is like its own arms. And if the company is going to differentiate the conventional stores in terms of margins then it would be similar to chopping its own arms because the conventional retailers may start purchasing from giants like Reliance Retail who may provide higher margins as mentioned in the above point.

FUTURE TREND : SCOPE OF 24hr RETAILING

The concept of 24hr. retailing in India has been present only in very limited formats like the pharmaceuticals (Apollo) and fuel retail outlets (H.P, Reliance etc.) and the other retail formats used to operate only till the early hours of the night. But because of the changing lifestyles and the buying habits of the consumers the retailers have been extending their operating hours till late nights.